Why Protein?

Almost all foods contain some protein, but as a dietary category the term ‘proteins’ tends to be used to describe foods which are particularly rich in this macronutrient as a percentage of their overall energy content. These ‘protein’ foods may originate from animals (for instance in the form of meat, fish, eggs and dairy products) or from plants (including beans, pulses, legumes, and derivatives of such crops such as tofu, tempeh, and soy milk). More recently, these familiar categories of ‘protein’ foods have been joined by processed ‘alternative protein’ products designed to resemble meat, fish, eggs and dairy products, which may be derived from plant-originated ingredients, from insects, from micro-organisms such as fungi, algae and bacteria, or from animal cells grown as part of a tissue culture. However, for reasons of affordability and accessibility, much of the dietary protein consumed by many people in sub-Saharan Africa comes from foods (including wheat, maize, sorghum and millet) which nutritionists typically classify as ‘carbohydrates’. Since these foods constitute the bulk of many people’s overall diets, they also contribute the majority of their dietary protein intake.

Protein has been a nutrient of particular interest, and its place in the diets of citizens of nations in the Global South a matter of concern, to international development actors at least since the establishment of organisations such as the UN Food and Agriculture Organisation (FAO) and World Health Organisation (WHO) in the 1940s and 1950s. Influenced by research carried out by colonial governments during the early 20th century, to which many of their early leaders had contributed, these organisations quickly identified that on average citizens of many Asian and African countries consumed less protein – and specifically smaller quantities of animal products – than did European and North American populations. These organisations presumed that this difference indicated that African, South Asian and Latin American diets were deficient in protein in comparison to those which prevailed in the Global North, and arguing that this ‘lack’ of protein was implicated in conditions such as kwashiorkor. They therefore claimed that malnutrition in the Global South reflected a global ‘protein gap’ and that too little protein was being produced to ensure the good health of much of the world’s population. As a result they sought to increase protein consumption among these populations through measures ranging from investment in dairy production in Africa to the development of novel protein supplements based on peanuts, soybeans, fungi and even cottonseed (Blaxter and Garnett, 2022).

By the 1970s the estimates of dietary protein requirements which underpinned these programmes, and the existence of a global ‘protein gap’, were being questioned openly. During this period some critics described nutritional scientists’ and international development practitioners’ emphasis during the 1950s and 1960s on increasing protein production and consumption as a ‘great protein fiasco’ (Kimura, 2013). In more recent decades official recommended daily protein consumption guidelines for children have been reduced significantly. Meanwhile, WHO and FAO nutritional guidance has shifted away from viewing insufficient consumption of ‘protein’ in general as a direct cause of malnutrition and delayed growth in children to place greater emphasis on protein-energy malnutrition and on deficiencies in specific amino acids (IPES-Food, 2022). However, as will become clear in this report, anxieties about the potential for protein production (and consumption) deficits to emerge as a result of future population growth remain current among international development actors and continue to inform their investment agendas.

While 20th century development practitioners tended to worry that too little animal protein was being produced and consumed in much of the Global South, long-running debates about how much protein is required for a healthy diet (and which foods might be best able to provide it) have recently taken on a very different complexion. Recent anxieties among consumers in the Global North about the perceived health impacts of meat and dairy consumption have combined with increasing attention to the growing environmental impacts of livestock production (notably the greenhouse gases emitted by ruminant animals and the deforestation footprint of animal feed production). Taken together, these developments have produced increasing concern among policymakers, and increasingly among some consumers and investors, over the unintended consequences of rapid growth in global livestock populations during recent decades. These developments have led to calls in some quarters for a shift towards consumption of protein derived from crops such as beans and pulses and from alternative protein products. As a recent IPES-Food (2022: 15) report notes, in this context “the impacts of meat, dairy, eggs, and fish are being compared against one another, against pulses and other high-protein plants, and against ‘alternative proteins’ – including novel plant-based substitutes, lab-grown meat, and insect-based foods” in novel ways.

As discussed above, what is included in or excluded from this category of ‘high-protein’ foods is often far from self-evident. Moreover, such ‘protein talk’ and ‘protein thinking’ travels very unevenly among those who concern themselves with African food systems and some of our interviewees questioned the salience of protein as a category of analysis. Nevertheless, some development finance institutions have explicitly identified ‘animal protein’ production as a priority sector for investment (CDC Group, 2020), and some major meat processing corporations are also rebranding themselves as ‘protein companies’ (Money and Cottee, 2021). For at least some important food system actors, livestock agriculture therefore increasingly appears to form part of a broader field of ‘protein production’ and we wished to explore how this change might be reshaping the concerns, goals and investment decisions of those who finance African food systems. In consequence, this report uses the category of ‘high-protein foods,’ or simply ‘protein’, to look beyond patterns of investment in animal products such as meat, dairy, eggs and fish alone and to explore them in relation to the financing of protein crops and of alternative protein products.

Why sub-Saharan Africa?

This report focuses on sub-Saharan Africa due both to the rapidly changing place of protein in the diets of many of its inhabitants and to the persistence within the region of economic, nutritional and environmental challenges with far-reaching implications for food systems. Rates of food insecurity and undernourishment are high across many sub-Saharan African countries, with average annual income per capita across the region standing at $1,675 as of 2020 and households spending on average around 38% of their incomes on food (OECD and FAO, 2021). The UN Food and Agriculture Organisation (FAO et al., 2022) found that 23% of people in sub-Saharan Africa had faced hunger and 63% had experienced moderate or severe food insecurity during 2021, while 261 million people within the region were undernourished (making up more than one third of the global total). However, it is important to note that statistics averaged across the region often conceal large variations in agricultural production, economic conditions and dietary practices both between different countries and between different populations within individual countries. For instance, while Nigerian households spend an average of 50% of their incomes on food, in South Africa the average share of household income spent on food is only 16% (OECD and FAO, 2021).

Per capita consumption of protein (including both animal products and protein derived from other sources) is low by global standards across much of the region, with analysis of FAO data revealing that in 2017 average protein supply for consumption across the region was 53.9g per capita per day. By contrast, it averaged 84g per capita per day in Latin America and the Caribbean, 98.6g in East Asia, 105.3g in Western Europe and 111.7g in North America. Average supply of animal protein across sub-Saharan Africa was especially low – averaging 10.7g per capita per day in 2017, in comparison to 40.7g in East Asia, 42.9g in Latin America and the Caribbean, 63.4g in Western Europe and 70.9g in North America.

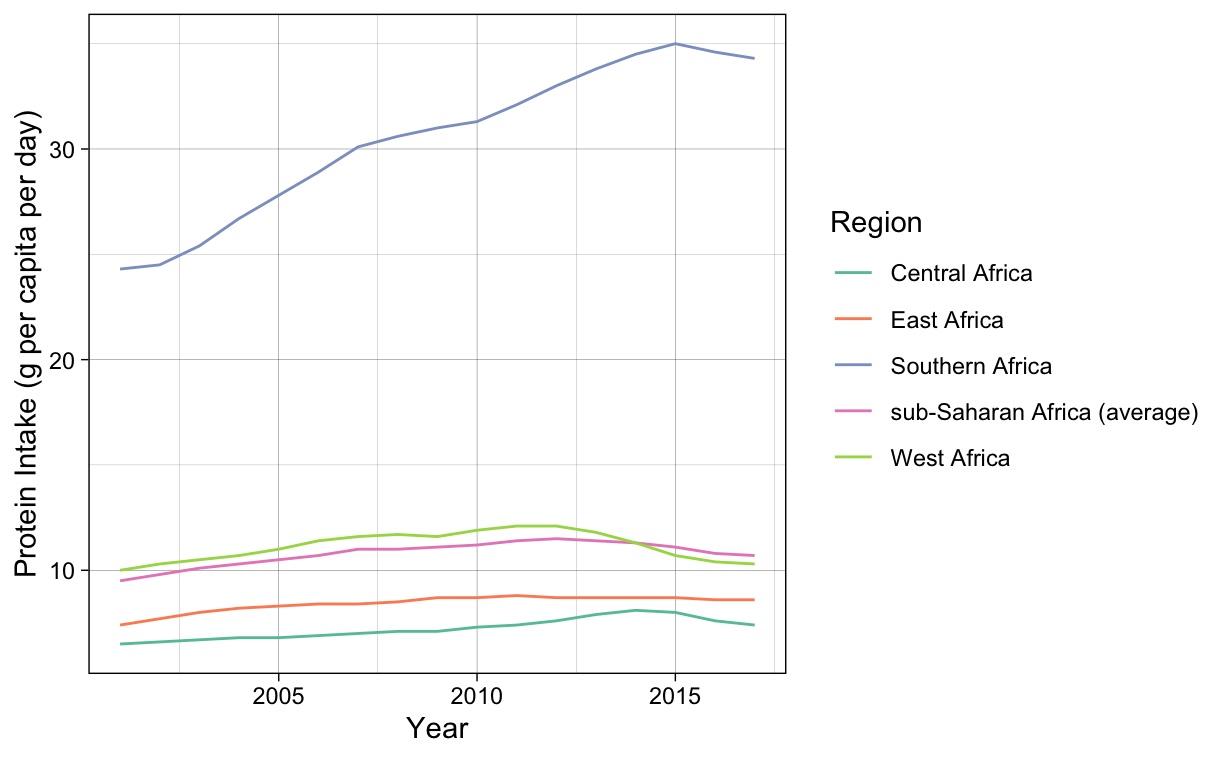

Figure 1: Daily animal protein supply per capita across sub-Saharan Africa and sub-regions, 2001-2017. (Data source: FAOSTAT database).

However, as Fig. 1 illustrates, patterns of animal protein consumption also vary significantly within sub-Saharan Africa. Average daily animal protein consumption per capita remained relatively stable at between 6g and 12g per capita per day across East, West and Central Africa between 2001 and 2017. However, in Southern Africa it increased significantly from 24.3g per day in 2001 to 34.3g per person per day in 2017. Southern Africa’s higher (although still low by global standards) average daily intake of animal protein appears to result primarily from higher per capita rates of animal protein consumption in South Africa (36g per person per day in 2017) – where most of the region’s population is concentrated – and in Botswana (27.7g per person per day in 2017).

Reflecting these low per capita rates of animal protein consumption, while sub-Saharan Africa is home to 14% of the world’s population, and holds 15% of global crop land and 20% of global pasture, it accounts for only 4% of global meat consumption, 5% of global fresh dairy product consumption and 6% of global fish consumption. By contrast sub-Saharan Africa accounts for 37% of global root and tuber consumption, suggesting that the diets of a substantial proportion of its citizens are currently more focused on starchy vegetables than are those of inhabitants of other regions (OECD and FAO, 2021).

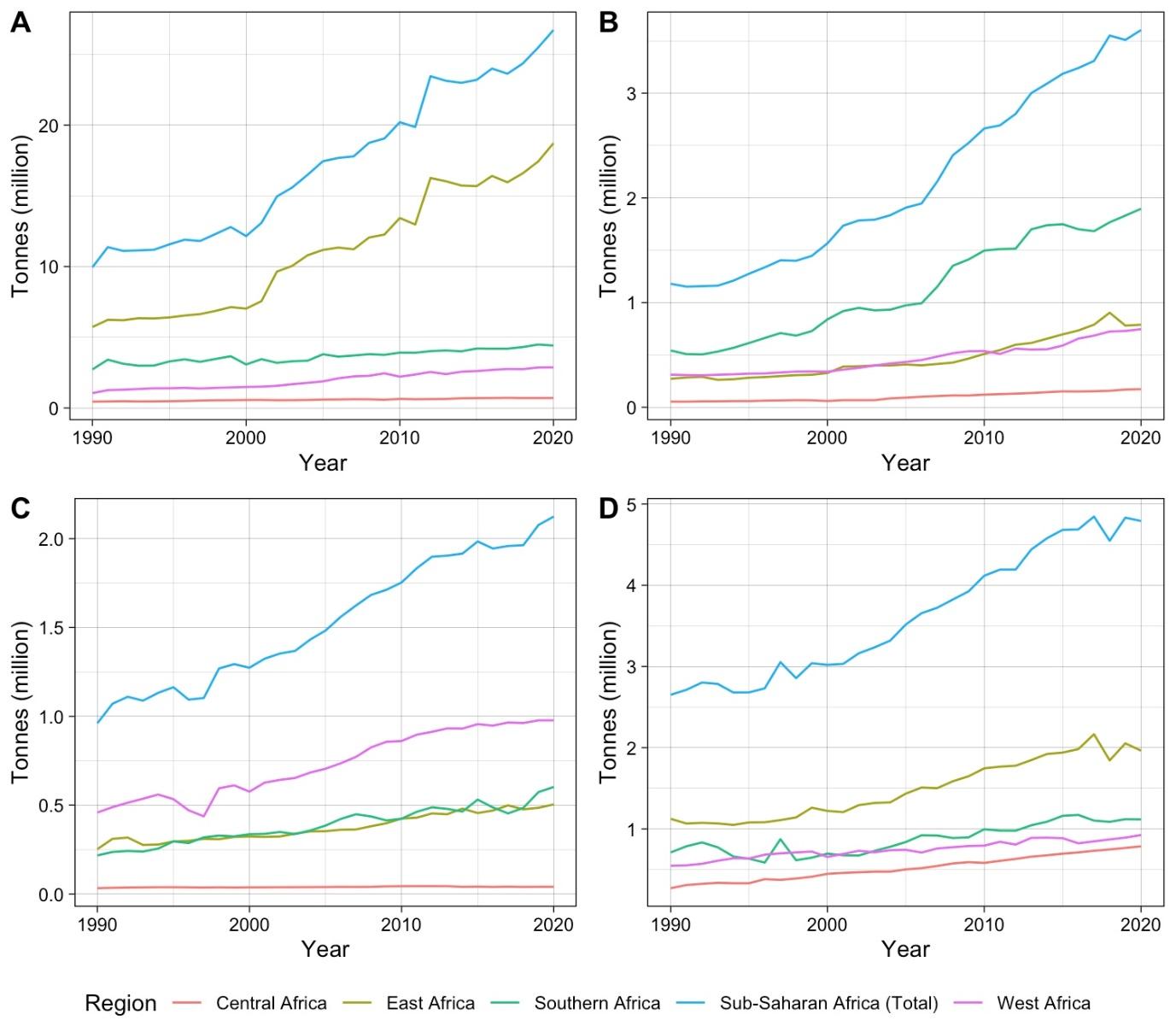

Figure 2: Production of key animal proteins in sub-Saharan Africa and sub-regions, 1990- 2020. Clockwise from top left: A) whole milk production; B) chicken meat production; C) egg production; D) beef and veal production. (Data source: FAOSTAT database).

Nevertheless, animal protein production has increased rapidly across much of sub-Saharan Africa in recent decades. As Fig. 2 highlights, whole milk production across sub-Saharan Africa has more than doubled from 9.9 million tonnes in 1990 to 26.7 million tonnes in 2020, with rapid growth in production in East Africa accounting for the vast majority of this increase. Meanwhile, chicken production has roughly trebled from 1.2 million tonnes in 1990 to 3.6 million tonnes in 2020 as illustrated in Fig. 3. The largest driver of this increase has been a near- quadrupling of chicken production from 542,000 to 1.9 million tonnes in Southern Africa, although both East and West Africa have also experienced significant growth in chicken production. Meanwhile production of eggs has more than doubled from 960,000 tonnes in 1990 to 2.1 million tonnes in 2020, while beef production has nearly doubled from 2.6 million to 4.7 million tonnes, although in both cases growth in production appears to have been distributed more evenly across different subregions of sub-Saharan Africa. The FAOSTAT database also records that over the same period pork production has nearly trebled from 626,000 to 1.6 million tonnes and sheep meat production has grown from 486,000 to 1.1 million tonnes, with significant increases in production recorded across all regions of sub-Saharan Africa.

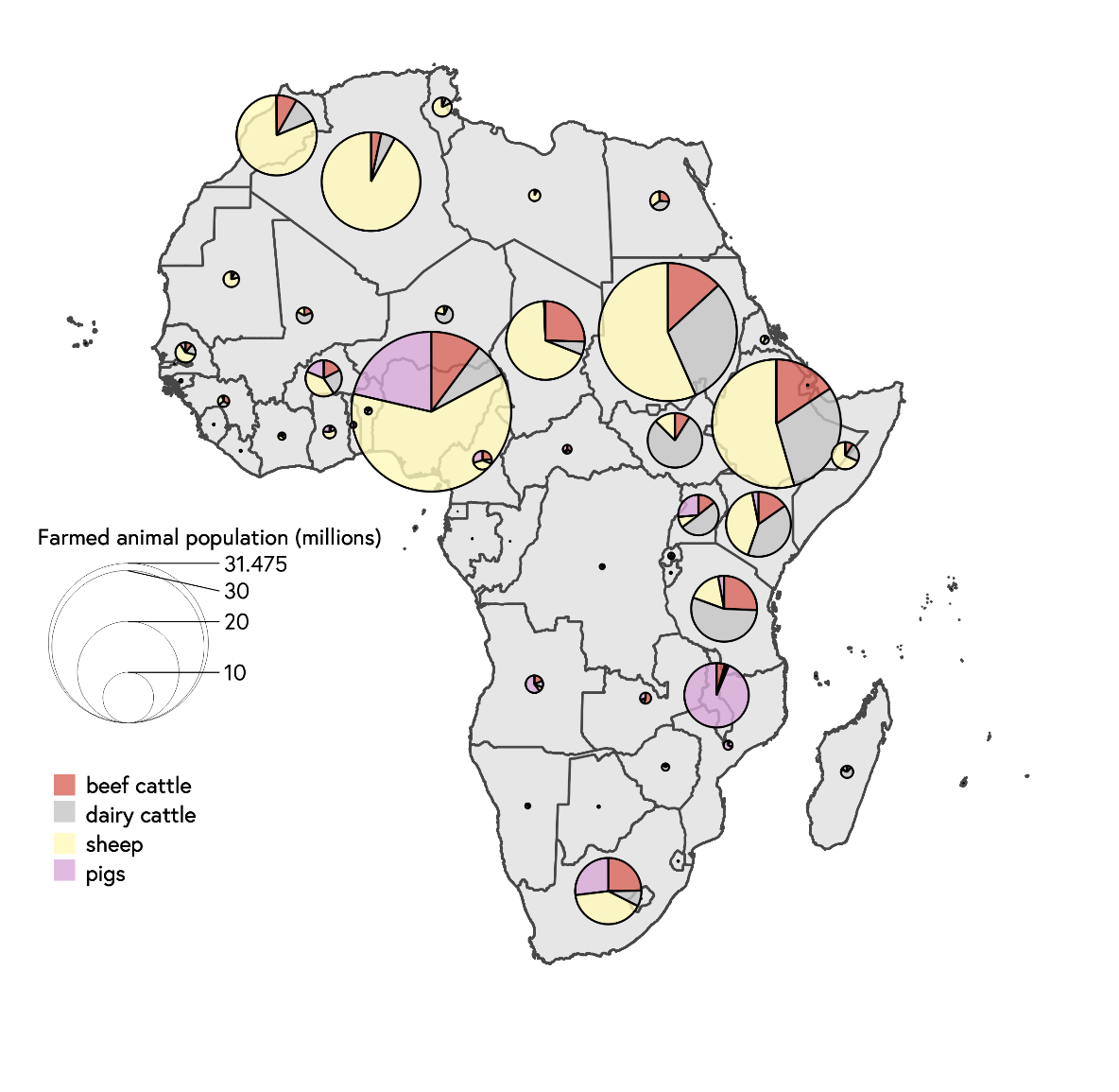

Figure 3: Farmed animal populations across Africa excluding chickens, 2020. Data source: FAOSTAT database.

As of 2018, Africa’s total livestock population was estimated to include 1.9 billion chickens, 438 million goats, 384 million sheep, 356 million cattle, 40.5 million pigs and almost 31 million camels (Malabo Montpellier Panel, 2020). East African countries such as Kenya, Tanzania, Ethiopia, South Sudan and Uganda – along with Nigeria and Chad– are home to the region’s largest populations of both beef and dairy cattle (as shown in Fig. 3). Meanwhile the region’s largest populations of sheep are found in Nigeria, Ethiopia, Chad, Kenya and South Africa. Additionally, Nigeria, South Africa, Uganda, Angola and Malawi have emerged as sub-Saharan Africa’s largest pig producers – although it is important to highlight that the region’s total pig herd remains far smaller than those of the livestock species discussed above.

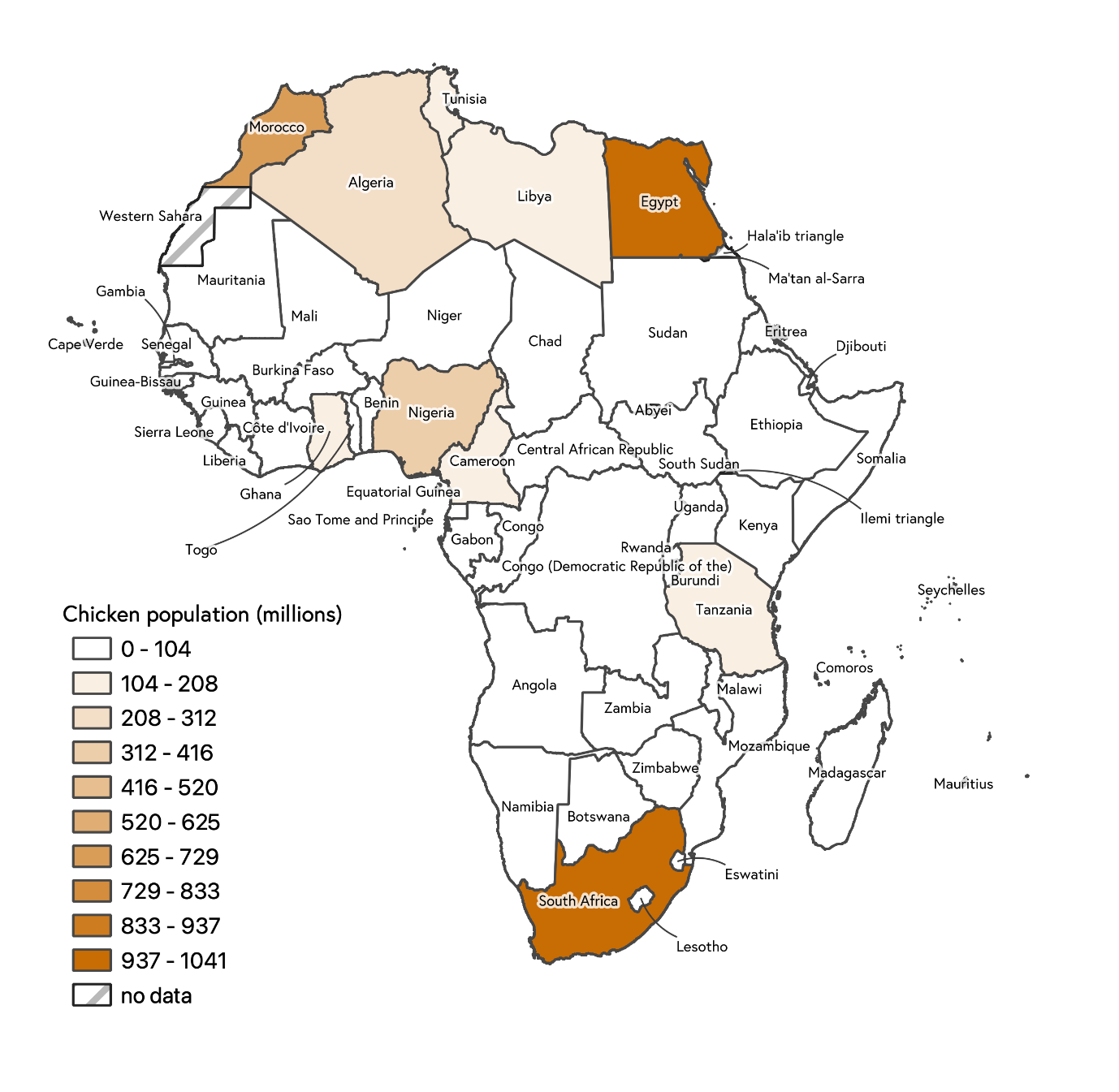

As Fig. 4 illustrates, South Africa is currently home to the region’s largest poultry populations by far, with 968 million broiler chickens and 49 million layer chickens. Nigeria has also emerged as an important producer both of poultry meat (with 238 million broiler chickens) and of eggs (with 121 million layer chickens). This is likely because large-scale intensive poultry production has become most firmly established in these two countries, while in most other sub-Saharan African countries only a small proportion of chickens and eggs (if any) are produced within large-scale intensive production systems. Indeed, as of 2018 pastoralists and smallholder farmers practicing mixed crop-livestock agriculture produced over 60% of the meat and milk consumed in West Africa and over 80% of that consumed in East Africa (Malabo Montpellier Panel, 2020).

Figure 4: Chicken populations across Africa, 2020. Data source: FAOSTAT database.

While the volume of animal protein produced in sub-Saharan Africa has increased rapidly over recent decades, due to population growth this has not been accompanied by a significant per capita increase in the volume consumed across the region (with the exception of Southern Africa). This trend is forecast to continue over the coming decade. Population growth rates in many sub-Saharan African countries are among the highest in the world and the region’s population is projected to increase by 31% (329 million people) between 2021 and 2030. Meanwhile the region is urbanising rapidly, and city-dwellers are expected to make up 47% of its population by 2030. These developments have prompted concern in some quarters that across much of sub-Saharan Africa the supply of protein will be unable to keep pace with population growth and changing dietary preferences over time, and thus that dietary protein intake per capita will decrease (and rates of malnutrition will increase), unless domestic protein production is expanded significantly (OECD and FAO, 2021).

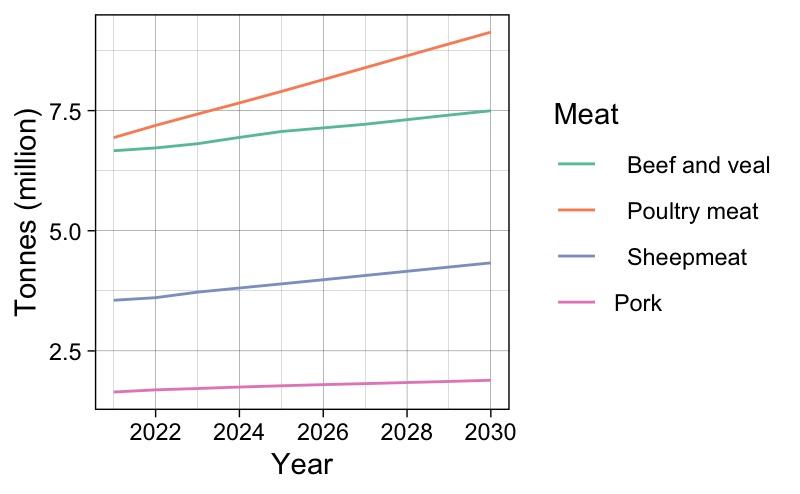

Figure 5: Projected African meat and egg production, 2021-2030. Data source: OECD & FAO (2021).

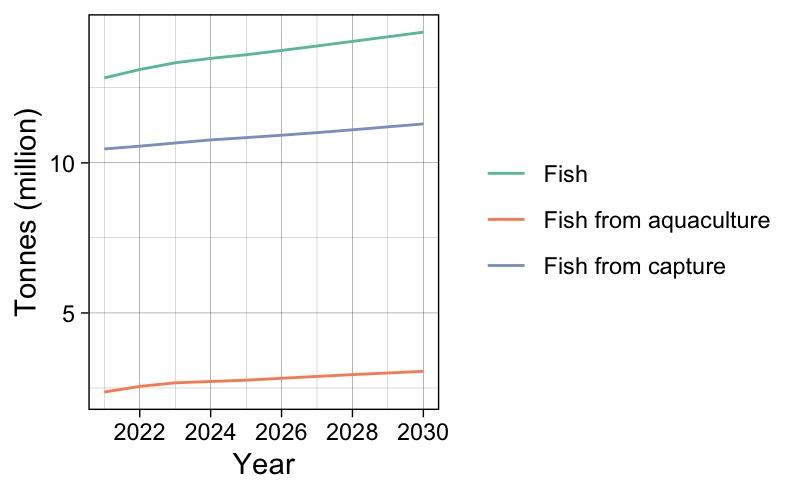

Figure 6: Projected African fish production, 2021-2030. Data source: OECD & FAO (2021).

The OECD and FAO (2021) forecast that the quantity of meat produced in sub-Saharan Africa will increase by 2.9 million tonnes (or 23%) between 2021 and 2030. As Fig. 5 illustrates, poultry meat is projected to make up the largest share of this increase (1.3 million tonnes) followed by beef and veal (740,000 tonnes), sheep meat (650,000 tonnes) and pork (260,000 tonnes). These organisations project that a shift from small-scale ‘backyard’ chicken rearing towards indoor intensive systems will enable this rapid increase in poultry production, while other forms of livestock agriculture will remain more focused on extensive production. Meanwhile, dairy production across sub-Saharan Africa is expected to grow by 33% (or 1.2 million tonnes) over the same period and the quantity of pulses produced is projected to increase by 27% (approximately 5 million tonnes) between 2021 and 2030.

The OECD and FAO also forecast that the volume of fish produced through aquaculture will increase by 28% over the same period (see Fig. 6), although under this projection aquaculture will still account for only 9% of total fish production in the region in 2030. Given that these projected increases in animal protein production are smaller in percentage terms than expected population growth within sub-Saharan Africa over the same period, these organisations expect them to be insufficient to satisfy additional demand for animal protein over time. They therefore forecast that “[o]ver the course of the next decade, import volumes of cereals, meat, fish, sugar and oils [will] rise substantially” (OECD and FAO, 2021: 88).

However, the OECD and FAO study also suggests that expansion in animal protein production within the region is likely to come at an environmental cost, forecasting that sub-Saharan Africa will experience a 20.95% increase in greenhouse gas (GHG) emissions from livestock over the same period. Under this projection: “Sub-Saharan Africa will account for 62% of the global increase in direct emissions from agriculture and will reach a share of 16% of global direct emissions by 2030” (OECD and FAO, 2021: 87). While the OECD and FAO study does not explore the reasons for this projected increase in GHG emissions in any detail, it projects that the total quantity of land used for crop production and pasture across sub-Saharan Africa will expand by only 0.47% (roughly 4,000 ha) between 2021 and 2030. This suggests that these organisations expect rising emissions to be driven by the raising of increasing numbers of animals on existing agricultural land, rather than by the conversion of new land within sub-Saharan Africa either to pasture or to feed crop production. Given the study’s prediction that imports of meat and fish into sub-Saharan Africa will also rise, these increases in livestock-related GHG emissions within the region appear likely to be accompanied by a commensurate increase in emissions in the countries of origin of imported meat and dairy products.

Sub-Saharan Africa is thus a region in which average per capita consumption of animal products is low, while rates of undernutrition and food insecurity remain high. However, it is also a region where rapid population expansion and economic growth are expected (as the next section discusses) to produce substantial increases in demand for meat, dairy products, fish and eggs. It is a diverse region which is forecast to account for a sizeable proportion of global growth in animal protein production and therefore in livestock-related GHG emissions over the coming decade, even as many of its constituent countries import increasing volumes of meat and dairy products. Sub-Saharan Africa might therefore reasonably be characterised as a region in which both protein production systems and protein consumption practices are undergoing a transition.

Nutritional Transitions

The changes in sub-Saharan African food systems forecast by the OECD and the FAO (2021) align only partially with longstanding and influential models of the relationship between socio-economic change and dietary transformation. Since the late 1960s, nutrition researchers and prominent international organisations such as the FAO and the World Bank have observed that several dietary transformations are positively correlated with GDP growth and urbanisation. These include an increase in total calorie intake, an increase in the proportion of dietary calories derived from fats, an increase in the proportion of dietary protein derived from animal products and an increase in consumption of processed foodstuffs (Drewnowski, and Popkin, 1997; Popkin, 1993).

Building on these observations, scholars such as Popkin (1993; Drewnowski & Popkin, 1997) developed a classificatory model which identifies four different dietary patterns. Although these different patterns or ‘stages’ may occur at different times in different places, they are argued to occur in the following sequence: 1) hunter- gatherer provisioning; 2) labour-intensive, low-yielding agriculture punctuated by periods of famine; 3) receding famine as agriculture becomes more industrialised and incomes increase; and 4) the adoption of diets high in calories, sugar, animal fat and processed foods. Conventionally, this ‘nutritional transition model’ classifies countries of the Global North as occupying stage 4 at present. Meanwhile, the dietary transformations discussed in the previous paragraph are considered to occur as part of a transition from stage 3 to stage 4. As such, different counties of the Global South (and different populations within them) are characterised as occupying differing positions in a trajectory of transition from stage 3 towards stage 4 (Breewood, 2018; Poulain, 2021).

This ‘nutritional transition model’ depicts increasing consumption of protein, and specifically of animal products, as resulting directly from economic development and typically assumes that consumption of animal products will increase as they become more affordable relative to average incomes (Drewnowski and Poulain, 2018; Vranken et al., 2014). This produces an expectation that dietary patterns across the Global South will converge with those of the Global North as GDP per capita increases, although it allows that the types of animal products which are consumed most commonly may continue to vary for reasons of culture, religion and/or agricultural specialisation (Poulain, 2021; Schneider, 2014).

However, more recent research has highlighted modest decreases in the quantity of meat consumed per capita, and gradual increases in the proportion of citizens who describe themselves as vegetarian and vegan, in some countries of the Global North (Stewart et al., 2021). Meanwhile, alternative protein consumption has recently increased rapidly in many countries of the Global North, with plant milks accounting for 14% of total milk sales in the USA by 2018 (Money & Cottee, 2021) – possibly reflecting public concern about the environmental impacts of livestock agriculture and/or perceived negative health implications of diets high in animal products.

In consequence, some scholars suggest that per capita consumption of animal protein in some countries of the Global North may in future decline from its current high levels and that the share of dietary protein supplied by plant-based (and other) alternatives may increase (Vranken et al., 2014). Poulain (2021) argues that these developments suggests that the nutritional transition may be more reversible than previously assumed. However, it might be more precise to describe these recent developments as suggesting the possibility of an emerging fifth dietary pattern, or ‘stage’ of the nutritional transition, in which animal products are (to some extent) replaced by plant-based, insect-based, fermented and/or in vitro alternatives (Breewood, 2018). During the transition to this ‘fifth’ dietary pattern, per capita protein intake is expected to remain high, but consumption of animal products is projected to decline while consumption both of novel alternative proteins and of conventional plant proteins such as beans and pulses increases (Tziva et al., 2020). This process is also referred to by some researchers as the ‘second’ protein transition (Aiking and de Boer, 2020).

Aiking and de Boer (2020) suggest that these two distinct nutritional transitions are currently unfolding across the world simultaneously but in a geographically, socially and economically uneven fashion. Even as sales of alternative protein products grow in many European and North American countries, and investors and media commentators in the Global North discuss the prospect that the world may have reached (or be about to reach) ‘peak meat’, per capita consumption of animal protein continues to increase rapidly across much of the Global South. As such, increasing consumption of animal protein in the Global South, as many countries shift from stage 3 to stage 4 of the nutritional transition model, appears to coexist with a shift from animal proteins to alternatives in high-income countries as the Global North perhaps begins to transition from the fourth dietary pattern towards the fifth.

These developments raise questions about whether, as established nutritional transition models predict, sub-Saharan Africa will continue to experience rising rates of animal product consumption as GDP per capita increases or whether this dietary shift will be superseded by an accelerated transition towards plant and alternative proteins. However, little has so far been written about how these two distinct processes or stages of nutritional transition might interact – or about what actors, values or forms of power might be shaping its development – in locations beyond Europe and North America. This report contributes to understanding of these processes through investigating which actors are financing various forms of protein production in sub-Saharan Africa and examining the influences which guide their investment decisions.

Investor Expectations and Power

Addressing the role of financial institutions in driving and shaping these ongoing nutritional transitions is important because recent research suggests that they play a prominent role in enabling transformations in food systems and diets. Investors’ role in these processes has been especially well studied in relation to the ‘second nutritional transition’ described above, in which diets high in animal products are displaced by increasing consumption of plant-based and ‘alternative’ proteins (Lonkila and Kaljonen, 2021; Mouat and Prince, 2018).

Analyses examining the causes of dramatic growth in the availability and sales of alternative protein products in recent years often highlight the important role played by venture capital investors in financing the firms which produce them. By these accounts, venture capital investors motivated by an expectation of rapid growth in demand for plant-based meat and milk alternatives (and therefore in the revenues of alternative protein producers) have frequently supplied alternative protein manufacturers with the financial resources required to develop these products and make them available on mass markets (Forum for the Future, 2021). These investors, and (importantly) their expectations about future growth in alternative protein consumption, may thus actively have helped to bring about the food future that they had predicted (Chiles, 2013; Martin, 2015; Mouat and Prince, 2018).

Based on such examples it is often argued that under certain circumstances investors’ expectations about the future can become ‘performative’ – that is, they may “help bring into being the world they describe” (Lonkila and Kaljonen, 2021: 629) – by mobilising the financial resources required to make a change desired by the investor happen (Birch, 2022). Through such processes, investors’ expectations about the future may play a key role in bringing new food products, markets and value chains into existence. Alternatively they may prove instrumental in preventing their emergence through deterring investment – for instance rumours or disclosures which cast doubt on the future profitability of an already fragile company may seal its fate by prompting investors to withdraw their capital in expectation of its failure (Haikola and Anshelm, 2018). As such the capacity to produce authoritative visions for the future of food, and to convince investors to act upon these expectations may play an important role in enabling and channelling change in the organisation of protein production, provisioning and consumption. It thus constitutes a significant form of power within the food system (Mouat and Prince, 2018; Schneider, 2019).

These observations suggest that in order to understand the development and transformation of global food systems (and specifically that of protein production, provisioning and consumption in sub-Saharan Africa) it is important to establish which financial actors invest in protein production and to examine which products and production systems they finance. Crucially, however, they also highlight that in order to grasp what motivates these investors it is crucial to investigate the expectations which investors in protein production hold about the future and to explore the values, beliefs and theories of change from which those expectations arise (Borup et al., 2006; Martin, 2015). Understanding these expectations, or ‘investor visions’, is important because investment is an inherently future-oriented activity. Financial actors invest in order to produce a desired outcome in the future, whether this goal is financial in nature (for instance the realisation of a certain rate of profit on the original investment) or involves the achievement of some other objective (for instance the alleviation of rural poverty). Individuals’ and organisations’ decisions about whether or not to invest in a given activity are therefore typically based on certain expectations about “the developments of future values” (Ouma, 2020: 63).

Accordingly, the research presented in this report examined both who invests in protein production in sub- Saharan Africa and what visions for or expectations about the future of protein are held by and motivate these investors. In so doing it aimed to establish why particular groups of investors finance some places, protein sources, and sections of value chains (and perhaps neglect others). The following chapter outlines the methodology used to address these research questions, while the remainder of the report presents the findings of the research.

Comments (0)