Facts, figures, and the uses of soy

The three largest soy producers (by weight and production area) are Brazil, the US, and Argentina, who were jointly responsible for ~81% of global soy production in 2021. The US has been a leading soy producer since the 1940s, whilst South America’s share has increased enormously in recent decades. As of 2021, Brazil, Argentina, and Paraguay alone were responsible for 52% of global soy production, up from <3% in the 1960s. Moreover, in 2019, Brazil officially became the world’s largest soy producer1.

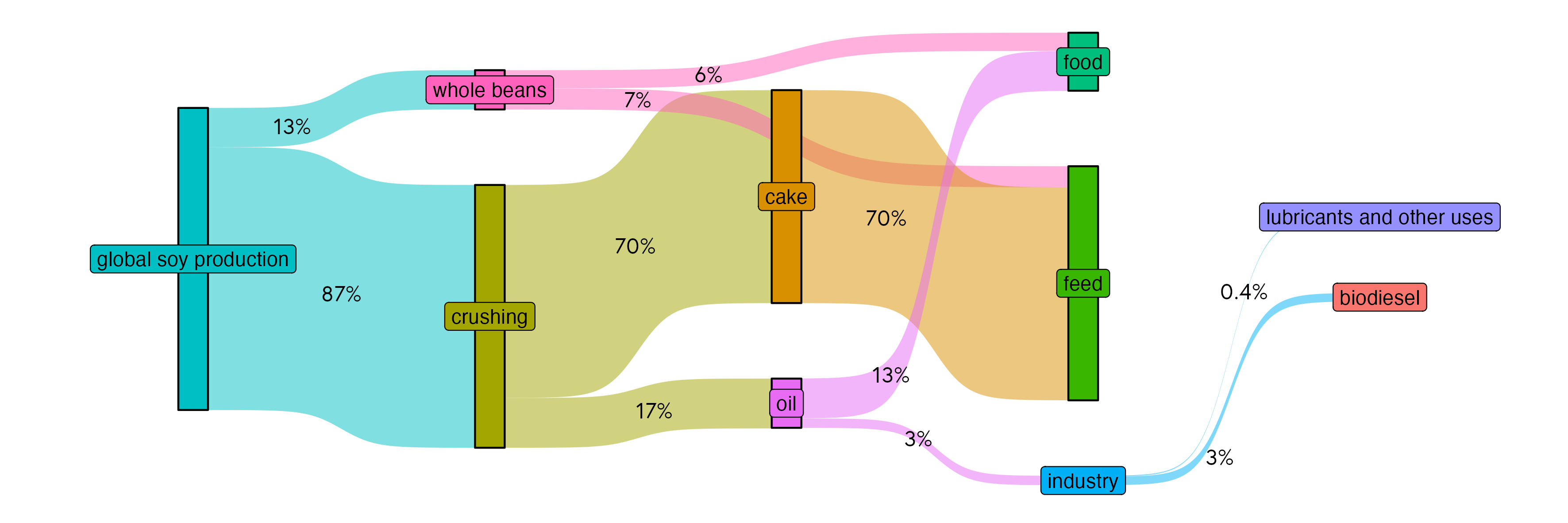

As with other legumes, soy fixes atmospheric nitrogen via its root system’s symbiotic relationship with nitrogen-fixating bacteria, meaning it can grow in poor soils and is less fertiliser-dependent than other crops. Soy also has a good balance of all nine essential amino acids that cannot be synthesised by the human body; and depending on the protein quality evaluation method used, soy scores similarly to animal-based protein sources. Whilst this does mean that soy can be a key protein source in plant-based diets, as demonstrated in the figure below, the majority (~75% by weight) is actually used in animal feed for livestock (primarily pig and poultry) production.

Figure 1: Sankey diagram displaying estimated soybean and soybean derivative usage by weight. Percentages are based on 2018-2019 data from the USDA and 2017-2018 expert estimations from the United Soybean Board. The use of soy oil for biodiesel was estimated by combining USB estimations with data from USDA biofuel annuals. Figure produced by TABLE.

-

1

This data has been updated compared to the original explainer. The updated data was collected from: Food and Agriculture Organization of the United Nations. Crops. FAOSTAT (n.d.). Available at: http://www.fao.org/faostat/en/#data/QC/visualize. (Accessed: 2nd May 2023).

Comments (0)