Will Nicholson is leading the Food Foundation work on metrics for sustainable and healthy diets and the multi-partner initiative, Plating Up Progress, that aims to further their uptake in the food industry. He has a background of working across both industry and NGO initiatives using research and analysis to understand and map how the food industry is responding to challenges around nutritional and environmental issues.

Image: Alina Grubnyak, Selective focus photo of bundle of apple, Unsplash, Unsplash license

Image: Alina Grubnyak, Selective focus photo of bundle of apple, Unsplash, Unsplash license

In 2018 the Food Foundation and FCRN collaborated on a project called Plating Up Progress (PUP) (see reports from 2019: Part 1 and Part 2). Using the UK as a case study, PUP set out to define the metrics that the food industry should be using to track progress towards healthy and sustainable food systems, and to engage with key stakeholders such as investors to use these metrics as a lever for change.

PUP’s focus was on consumer-facing food businesses such as supermarkets, foodservice caterers and both quick service and casual dining restaurant chains, our reasoning being they are in a unique position to influence the required transitions in both consumption and production. These businesses are the gatekeepers of our diets and the funnel through which most commercially produced food is channelled. Put simply, if we don’t see the changes in these sectors then the changes probably aren’t happening.

Since then the project has moved across to the Food Foundation. In July 2020 we released our first dashboard assessing 26 UK-operating companies (11 retailers, 6 quick service restaurant chains, 5 contract caterers and 4 casual dining chains) across multiple issues:

- Healthy and sustainable products and services

- Encouraging healthy diets

- Climate change

- Biodiversity

- Sustainable food production

- Water

- Food loss & waste

- Plastics

- Animal welfare & antibiotics

- Human rights

The full dashboard can be accessed here and each company’s profile can be downloaded with full data transparency. We have only included information that is in the public domain, for example company websites, corporate reports and recognised disclosure platforms such as CDP (formerly Carbon Disclosure Project and now a corporate disclosure platform for climate change, water and forests) and investor-focused benchmarks. Our data collection also included a month-long fact-checking period for each business to correct any potential omissions or misinterpretations. In this blog, we focus on the key findings, how COVID-19 may be influencing the sustainability agenda and why a long-sighted and clear-headed response to COVID-19 is needed if we are to avoid building back to a “business-as-usual” economy. We will also be delving deeper into these topics in our upcoming report in November 2020.

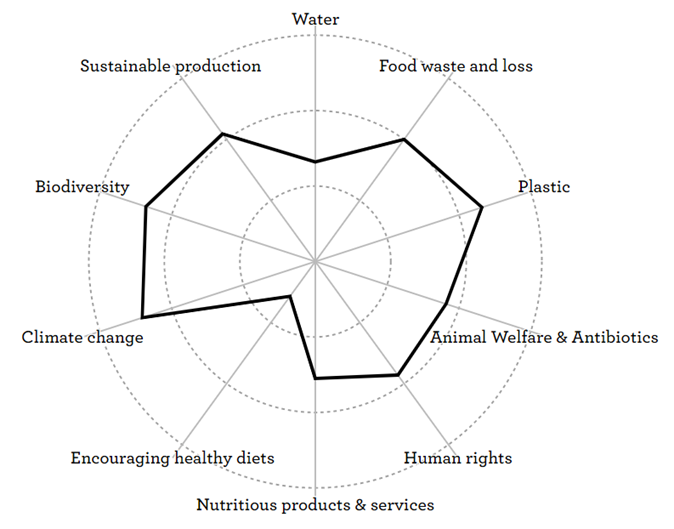

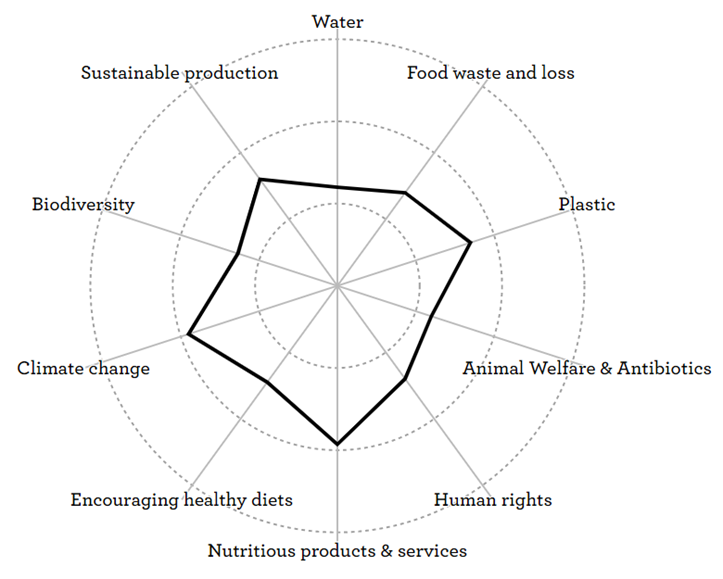

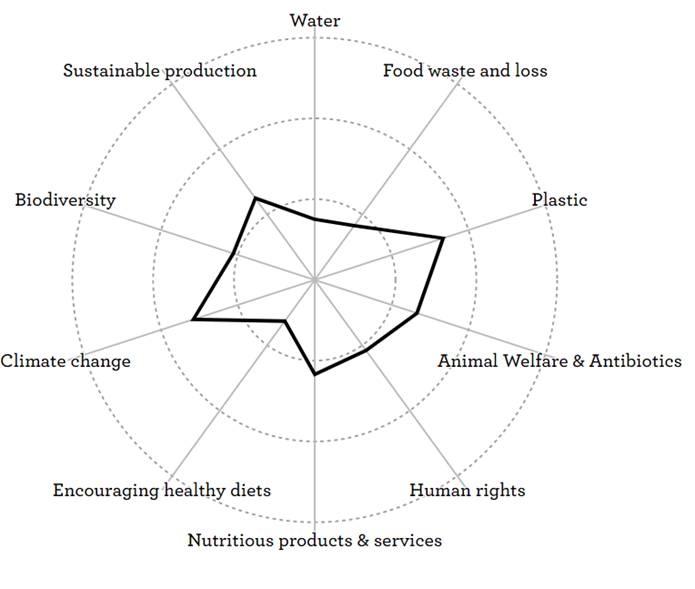

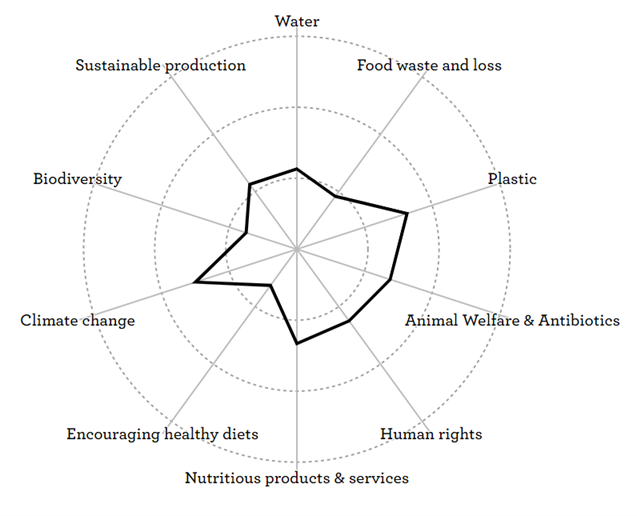

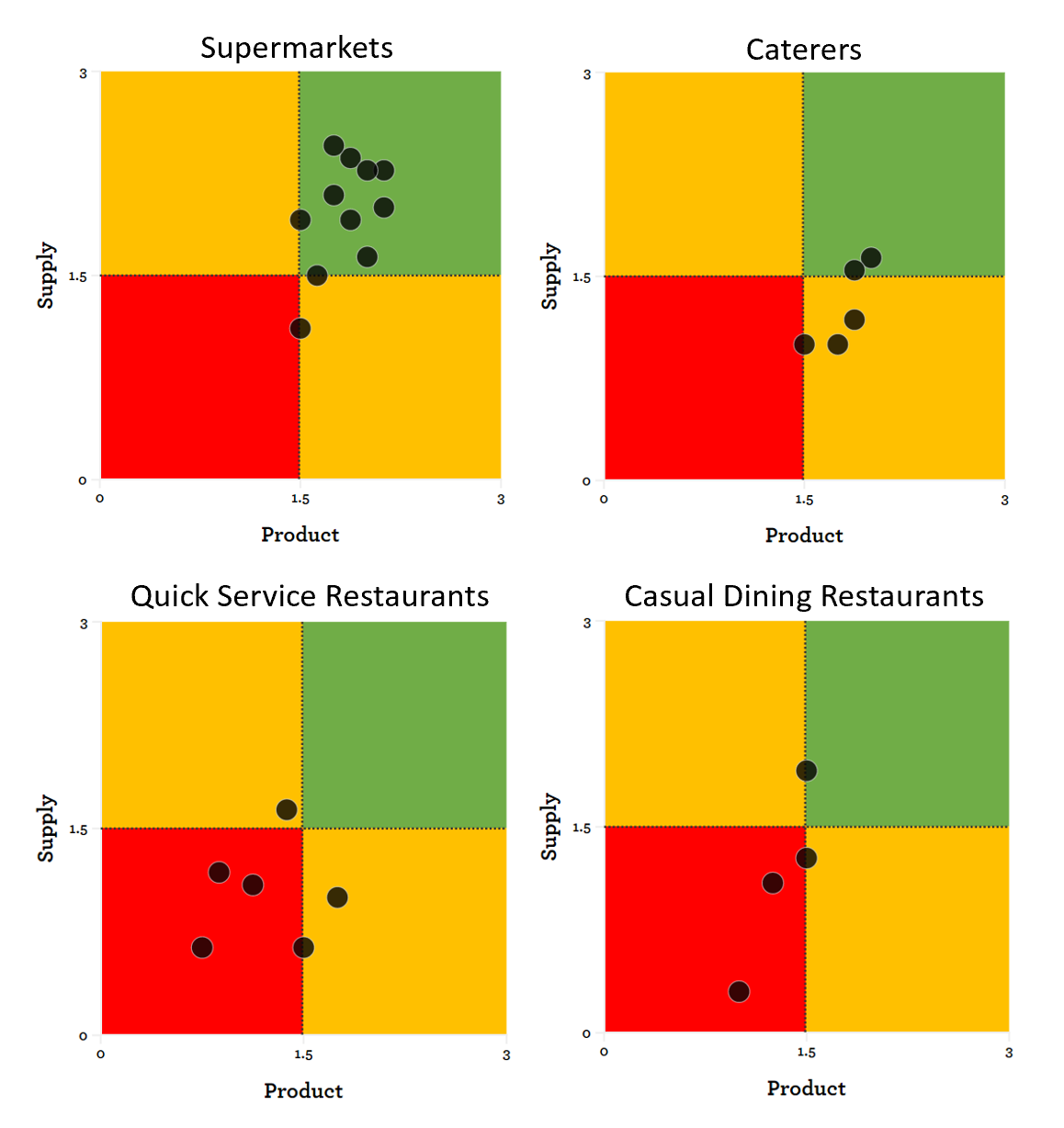

Supermarkets generally lead the way, but no sector can be considered “future-fit”

Overall, this year’s analysis reinforced the fact that “changing our diets” is still an emerging theme for business commitments – almost all companies still lack clear targets for this. Generally speaking, the supermarkets have made more progress on environmental issues than restaurants and caterers but health & nutrition remains a gap across sectors (see Figure 1). We do however see some indications of leadership, notably supermarkets beginning to combine nutrition and environmental impacts for a more comprehensive set of targets. For example, Sainsbury’s Net Zero by 2040 commitments focus on reducing carbon emissions, food waste, plastic packaging, water usage and increasing recycling, biodiversity and healthy and sustainable eating, and Tesco is working towards an overall metric that includes sustainable diets alongside sustainable food production. In the out of home sector, Greggs and Sodexo have targets for sales of vegetables across their menus and products (but not including fruit), but these are by and large the exceptions.

Figure 1: Comparing average company assessment across key sectors (taken from the current PUP dashboard). Scores closer to outer rings of spider diagram represent better performance.

1a. Average profile for supermarkets

1b. Average profile for caterers

1c. Average profile for Quick Service Restaurants

1d. Average profile for Casual Dining Restaurants

Few companies are setting targets that genuinely drive changes in our diets and sustainable food production

One new approach we included this year was to “tag” each metric as being primarily concerned with businesses’ products or their supply chains. For example, a target for sales of vegetables is more clearly a product-related target and more obviously an indication that a company is addressing the need for changes in our diets. However, a target around the percentage of seafood coming from recognised certified sources is more obviously an indication that a company is addressing supply-side concerns for better production systems.

This approach (see Figure 2) highlighted that few companies were focusing on both their products and supply chains in a complementary way, but that supermarkets generally performed better in this respect (especially concerning their supply chains, although this comes with the caveat that most supermarket supply chain targets are limited to own brands).

Conversely, caterers tend to use menus to focus on products and diets, but are weaker on their supply chain sustainability. Quick service and casual dining restaurant chains are generally weaker on both products and supply chains, with a couple of outliers: McDonalds is noticeably stronger on targets for supply chain sustainability and Greggs is noticeably stronger on targets for healthy products than it is for supply chain targets.

The reason this distinction matters is that it allows us to better understand not just the issues that need more focus (Figure 1) but also where companies need to apply more focus on different levers for change (Figure 2) in terms of improving their products and working with their supply chains. We intend to improve the methodology behind this so that our 2021 dashboard helps investors and businesses to understand more about where more focus is really needed.

Figure 2: Comparing companies’ focus on products and supply chains (taken from the current PUP dashboard). The horizontal axis shows whether companies have made progress on making their products or menus more healthy and sustainable in terms of ingredients, use of packaging, and reducing food waste. The vertical axis shows whether companies have made progress on sustainable supply chains (for example deforestation-free supply chains, working with suppliers to improve uptake of sustainable production practices, engaging with suppliers on human rights issues). Ideally companies would all be in the top right-hand corner if they were focusing on both. While supermarkets are closer to where companies need to be, it should be noted that supermarkets’ main focus has so far been on own-brand targets only. Please note, our methodology for this is still evolving and we are looking how to improve this.

COVID-19: opportunity for change or a step backwards

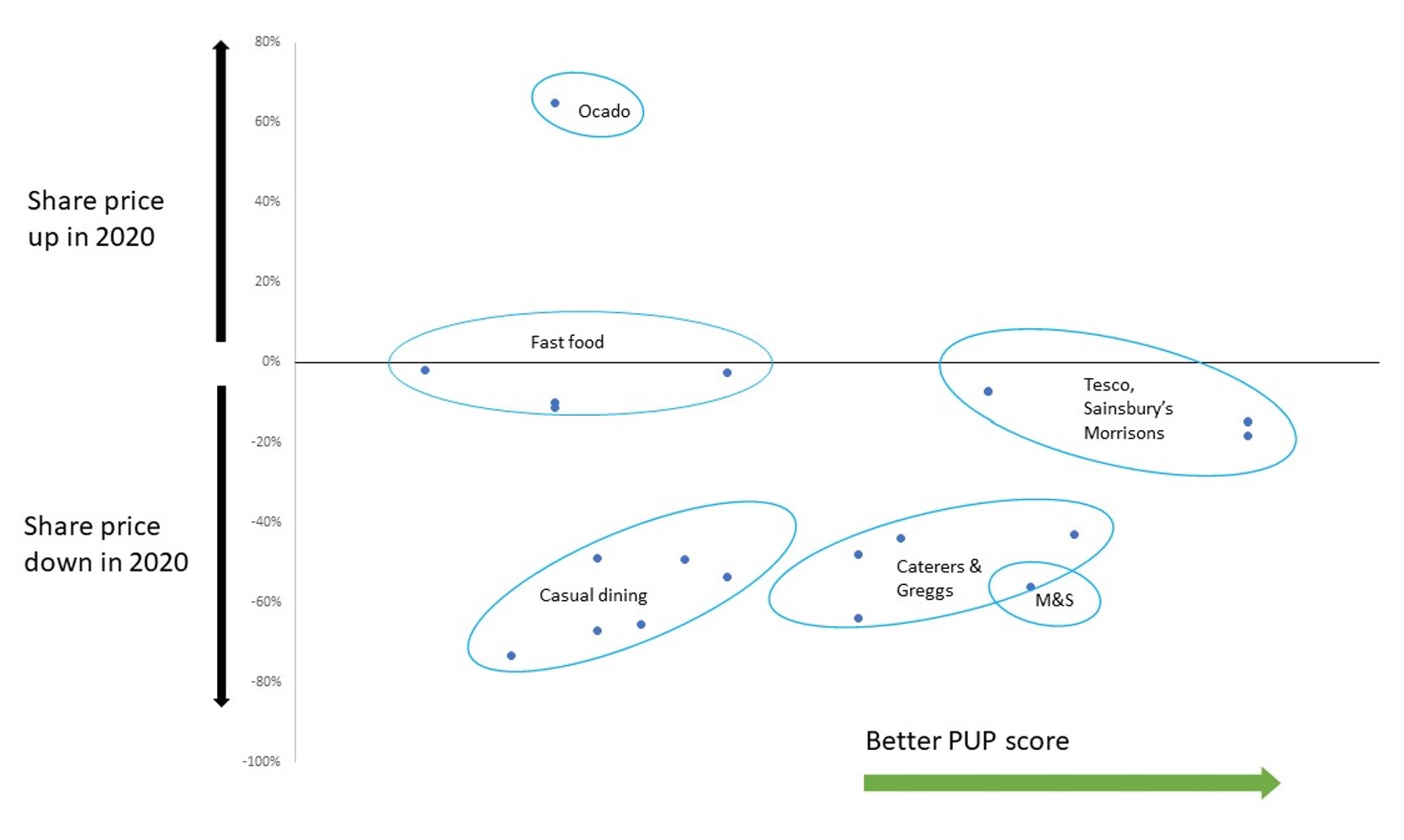

The economic impacts of COVID-19 on the food industry have been significant, although uneven. Focusing on our key Plating Up Progress sectors, our share price tracker shows that retailers have generally recovered better from the early impacts they experienced in March, seeing significant growth in food sales. Those able to capitalise on demand for online ordering, home delivery and increased demand for shopping at local or convenience stores, have benefited most. The out of home sector experienced more acute negative impacts, with restaurant chains only able to reopen (where drive-through and takeaway is possible) in June and the casual dining sector only really able to reopen in July, under social distancing restrictions. Catering companies have been able to remain open in some sectors (notably for the health sector) but with most schools and most business offices remaining closed into the summer, recovery opportunities are challenging.

While share price is clearly only a proxy measure for economic impact, initial analysis shows that the immediate impacts of COVID-19 have not necessarily favoured companies with “better” PUP scores and more progressive public targets for a healthy & sustainable food (see Figure 3). This is almost certainly because we are still "in the eye of the COVID storm" but we should be aware of the long-term consequences on health and the environment of an economic recovery that simply gets businesses back on their feet and does not prioritise nutrition, the environment, and social justice.

Figure 3: Comparing share price fluctuation during COVID-19 with PUP assessment.

For example, the government’s obesity strategy and Eat Out To Help Out campaign illustrate the delicate balance between economic recovery and a transition to a healthy and sustainable food system. Two strategies are operating in conflict with one another: one aiming to reduce calorie intake and another encouraging people to eat out, regardless of the nutritional and calories content of the food or the extent to which different restaurants are able to manage the underlying risk of COVID-19 infection. Policy makers need to get this balance right by listening to different stakeholders including civil society, academics, health professionals, businesses, investors and, of course, people.

So what does a roadmap for the future look like? Given the economic impacts likely still to come from COVID-19, and the potential for further job losses across some of the food industry, there is a real need to balance boosting the economy and creating the environment that favours businesses that are making the most progressive commitments around health and sustainability. A five-year recovery plan that in effect brings us back to where we were in 2019 could be five wasted years of potential progress at a time when change is increasingly urgent. In our November report we will be mapping this in more detail, taking our dashboard as the starting point and bringing in the perspectives of a number of businesses and investors to highlight where the real opportunities for change exist, to identify some of the genuine barriers to change, and to propose some options for removing those barriers.

Comments (0)